fulton county ga vehicle sales tax

Vehicle Registration - Vehicle owners must renew their registration and pay the ad valorem tax every year with the county tax commissioner during the 30 day period which ends on their birthday. Vehicle Sales Tax Information.

30363 Zip Code Atlanta Georgia Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

Fulton county ga vehicle sales tax Saturday March 26 2022 Edit.

. A Any person who becomes the purchaser of any real or personal property at any sale made at public outcry by any executor administrator or guardian or by any sheriff or other officer under and by virtue of any execution or other legal process who fails or refuses to comply with the terms of the sale when requested to do so shall be liable for the amount of the purchase. These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military personnel killed in the line of duty and others. Certain types of Tax Records are available to the general public while some Tax.

According to CarsDirect Georgia has a state general sales tax rate of 4. Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. The minimum combined 2022 sales tax rate for fulton county georgia is 89.

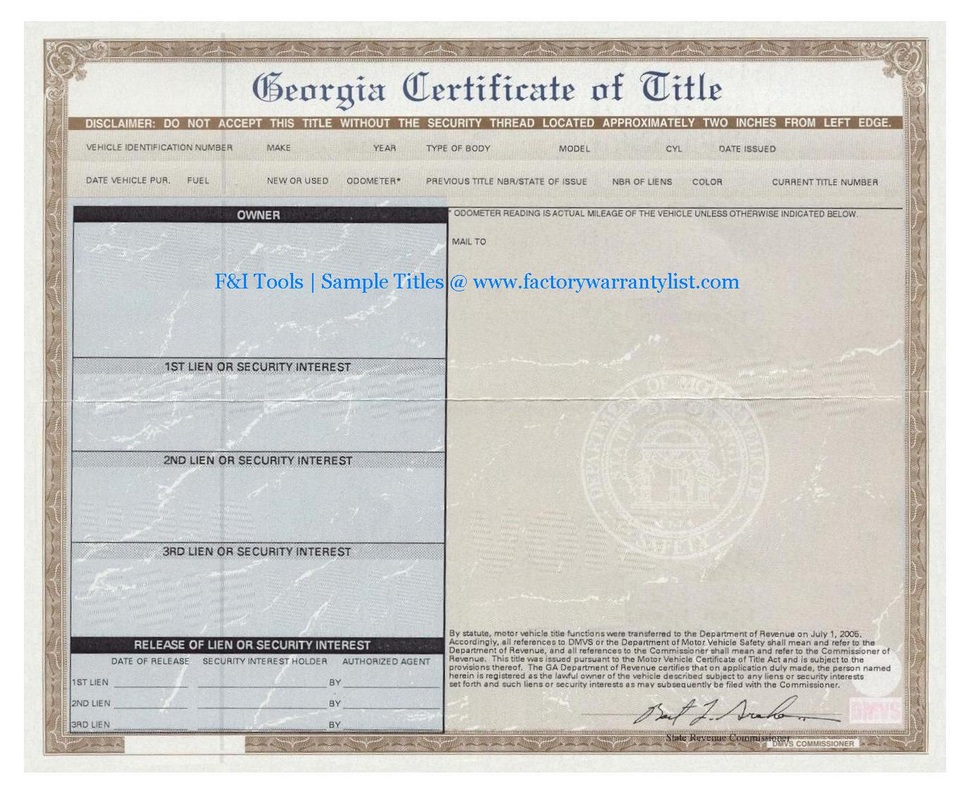

Title Ad Valorem Tax TAVT became effective on March 1 2013. Due to renovations at the Fulton County Courthouse. Fulton County Sales Tax not in Atlanta.

However this retail sales tax does not apply to cars that are bought in. TAVT is a one-time tax that is paid at the time the vehicle is titled. These records can include Fulton County property tax assessments and assessment challenges appraisals and income taxes.

This is the total of state and county sales tax rates. Income Tax Local Government Motor Fuel Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification Local Government Central Assessment Digest Compliance Distributions. The current TAVT rate is 66 of the fair market value of the vehicle.

If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The Fulton County Sheriffs Office month of November 2019 tax sales. The Fulton County sales tax rate is.

Because of these changes the title ad valorem tax or tavt tax is more fair for leasing consumers in. The 2018 United States Supreme Court decision in South Dakota v. Another 3 percent is fulton countys sales tax rate funding county operations.

In an effort to continue providing great customer service and convenience to Fulton County citizens the Fulton County Tax Commissioners Office has installed Motor Vehicle kiosks in several locations. Winning Bidder must pay by 4 pm on the 1 st Tuesday of the month. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other.

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred or a new resident registers the. There is typically no specific standard rate that you can completely rely on to determine the rate you should pay or collect so it is important to utilize the services of a professional tax. For TDDTTY or Georgia Relay Access.

SW TG500 Atlanta GA 30303 to receive their total amount due to Fulton County Sheriffs Office. 775 Fulton County Sales Tax in Atlanta. Sales Tax Rates - General General Rate Chart - Effective April 1 2022 through June 30 2022 2219 KB General Rate Chart - Effective January 1.

Bidders must register each month for the Tax Sale. What is the sales tax rate in Fulton County. Fulton County Sheriffs Office.

However this retail sales tax does not apply to cars that are bought. A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. On Tuesday August 2 City of Fulton residents have an opportunity to vote on continuing a vehicle sales tax on motor vehicles trailers boats and outboard motors purchased from outside the state of Missouri.

Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. The 1 MOST does not apply to sales of motor vehicles. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills.

Property taxes and vehicle registration. The kiosks will allow taxpayers from select counties to renew their motor vehicle registrations and receive renewal decals upon the completion of their transaction. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave. The minimum combined 2022 sales tax rate for Fulton County Georgia is. Home county fulton ga wallpaper.

185 Central Ave 9th Floor. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. The City of Fulton has depended on the vehicle sales tax averaging between 40000 and 120000 each.

The Tax Commissioner takes the appraised value and the exemption status. OFfice of the Tax Commissioner 404-613-6100 Property Tax Page 141 Pryor Street SW Atlanta GA 30303. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Supermarket Franchise Opportunities In India Franchise Opportunities Best Franchise Opportunities. Title Ad Valorem Tax TAVT became effective on March 1 2013. If the vehicle is owned by more than one.

For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes. The taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax FeeTAVT. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. The Fulton County Sales Tax is 3. The Tax Commissioner also is responsible for collecting Motor Vehicle Ad.

Please submit no faxesemails the required documentation for review to the following address below. Tax Sales-Excess Funds Procedure Application. The Georgia state sales tax rate is currently.

Any Bidder who fails to pay will be banned from. Fulton County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Fulton County Georgia. Fulton County GA sales tax is no different than most other counties in most states throughout the US.

All taxes on the parcel in question must be paid in full prior to making a refund request. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions.

Houston County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Motor Vehicles Henry County Tax Collector Ga

Sale At Carrollton Chicken Plant Gets Out Larger Than Expected Response

Insurance Commissioner Complaint Ga Diminished Value Car Appraisal

Tax Commissioner S Office Cherokee County Georgia

2823 Windsor Forrest Ct Atlanta Ga 30349 Mls 7020741 Coldwell Banker

Georgia Used Car Sales Tax Fees

Pathway Car Service Home Facebook

1216 Whitlock Ridge Dr Sw Marietta Ga 30064 Realtor Com

Motor Vehicles Henry County Tax Collector Ga

30363 Zip Code Atlanta Georgia Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

Chevrolet Silverado With 24in Forgiato Gambe 1 Wheels Exclusively From Butler Tires And Wheels In Atlanta Ga Image N Chevrolet Silverado Chevrolet Silverado

Insurance Georgia Department Of Revenue

Home Sandy Springs Ga Police Department

Boj To Consider Allowing Jgbs A Wider Range But Maybe Not Until March In 2021 Suga Bank Of Japan Japan

Home Sandy Springs Ga Police Department

Georgia House Oks Lost Mountain Vinings Cityhood Movements

Green Transporter Ev3 3 Wheel Mobility Scooter Mobility Scooter Abs Brake System Scooter

Ik Ben Klantvriendelijk Klantvriendelijkheid Is Het Voornaamste Voor Een Bedrijf Klantvriendelij Customer Experience Network Marketing Business Improve Sales